Discover the blessings of debt consolidation loans for dealing with more than one money owed effectively. discover ways to simplify bills and potentially lessen interest prices in this comprehensive guide.

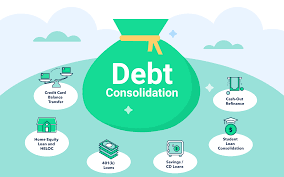

Debt consolidation loans provide a strategic technique to dealing with multiple debts by way of combining them right into a single, extra plausible mortgage. This economic device can assist simplify your monthly bills, reduce standard interest expenses, and streamline your debt compensation strategy. In this text, we’ll delve into the diverse blessings of debt consolidation loans, how they paintings, and whether they’re the proper solution to your financial situation. whether or not you are juggling credit score card balances, personal loans, or different forms of debt, information the advantages of consolidation can empower you to take manipulate of your budget and paintings towards a debt-loose destiny.

Information Debt Consolidation Loans

Debt consolidation involves removing a new mortgage to pay off present debts. The intention is to combine multiple money owed into one, generally with a lower hobby charge and a more favorable compensation term. right here’s how it works:

How Debt Consolidation Works

observe for a Consolidation loan: You apply for a brand new mortgage that covers the whole quantity of your present money owed.

Use price range to pay off money owed: once accepted, the budget from the consolidation mortgage are used to repay your current debts.

Make payments at the Consolidation mortgage: Going forward, you’re making a unmarried monthly fee closer to the consolidation mortgage, which normally has a lower hobby rate and a structured reimbursement plan.

Blessings of Debt Consolidation Loans

- Simplified Debt management

coping with more than one money owed can be overwhelming. Debt consolidation simplifies your price range by using consolidating multiple bills into one, decreasing the probabilities of missing due dates and overdue expenses. - lower hobby prices

Consolidation loans often come with lower interest rates as compared to credit cards and different high-interest money owed. this can save you cash on interest bills over the lifestyles of the mortgage. - unmarried monthly fee

as opposed to juggling multiple payments to different lenders, you are making a unmarried month-to-month fee toward your consolidation loan. this may make budgeting less difficult and decrease economic pressure.

4. potential to lower monthly bills

with the aid of extending the repayment term of the consolidation mortgage, you could lower your month-to-month payments. this could loose up coins float for different financial goals or prices.

- constant compensation agenda

Consolidation loans generally include a set compensation schedule, offering certainty approximately when you’ll end up debt-free. This contrasts with variable hobby quotes and uncertain charge quantities of credit score cards.

Is Debt Consolidation proper for You?

keep in mind Debt Consolidation If:

you have more than one high-interest money owed.

You conflict to keep tune of diverse price due dates.

you are trying to simplify your finances and reduce interest prices.

warning in opposition to Debt Consolidation If:

you are unable to comfy a lower hobby price than your modern-day money owed.

you have got a records of amassing new money owed after consolidating.

you are no longer devoted to changing spending conduct and financial behaviors.

Steps to Consolidate Debt successfully

- check Your money owed

bring together a listing of your first-rate debts, including balances, interest quotes, and month-to-month bills. this will help you determine the whole amount to consolidate. - shop round for Loans

evaluate consolidation loan offers from different lenders, thinking about interest prices, compensation phrases, fees, and eligibility requirements. search for a loan that fits your financial situation and desires.

3. Calculate financial savings and charges

Use on-line calculators or talk over with creditors to estimate how much you may shop with a consolidation mortgage compared for your current debts. component in any fees related to the brand new mortgage.

4. practice for the loan

as soon as you’ve got selected a lender and loan offer, complete the application procedure. Be organized to provide documentation of your earnings, debts, and other financial records.

5. Use finances accurately

as soon as accepted and funded, use the consolidation loan to repay your present debts straight away. avoid using the freed-up credit score strains to save you additional debt accumulation.

Final Thoughts

Debt consolidation loans can be a effective device for dealing with and lowering debt while used wisely. via consolidating excessive-hobby debts right into a single mortgage with favorable phrases, you can simplify your finances, lower your interest costs, and paintings closer to turning into debt-unfastened quicker. but, it is vital to cautiously examine your economic state of affairs, examine mortgage offers, and decide to accountable monetary conduct to maximise the blessings of debt consolidation.

FAQs

- Will debt consolidation hurt my credit score?

- Initially, there may be a slight impact due to a new credit inquiry and closing old accounts, but consistently making payments on time can improve your score over time.

- Can I consolidate different types of debt into one loan?

- Yes, you can consolidate various types of unsecured debts, such as credit cards, personal loans, and medical bills, into a consolidation loan.

- Are there fees associated with debt consolidation loans?

- Some lenders may charge origination fees or prepayment penalties. It’s essential to review the terms and conditions carefully before proceeding.

- What if I can’t qualify for a low-interest consolidation loan?

- Consider alternative options such as balance transfer credit cards, debt management plans, or seeking guidance from a credit counselor.

- How long does it take to pay off a consolidation loan?

- The repayment term varies depending on the loan amount, interest rate, and monthly payment. Typically, consolidation loans range from 2 to 7 years.