find out how to make use of peer-to-peer lending systems efficiently to borrow or invest coins. examine the advantages of peer-to-peer lending, the borrowing approach, and key elements to endure in mind earlier than participating in the ones online lending platforms.

getting to know Peer-to-Peer Lending systems: A entire manual

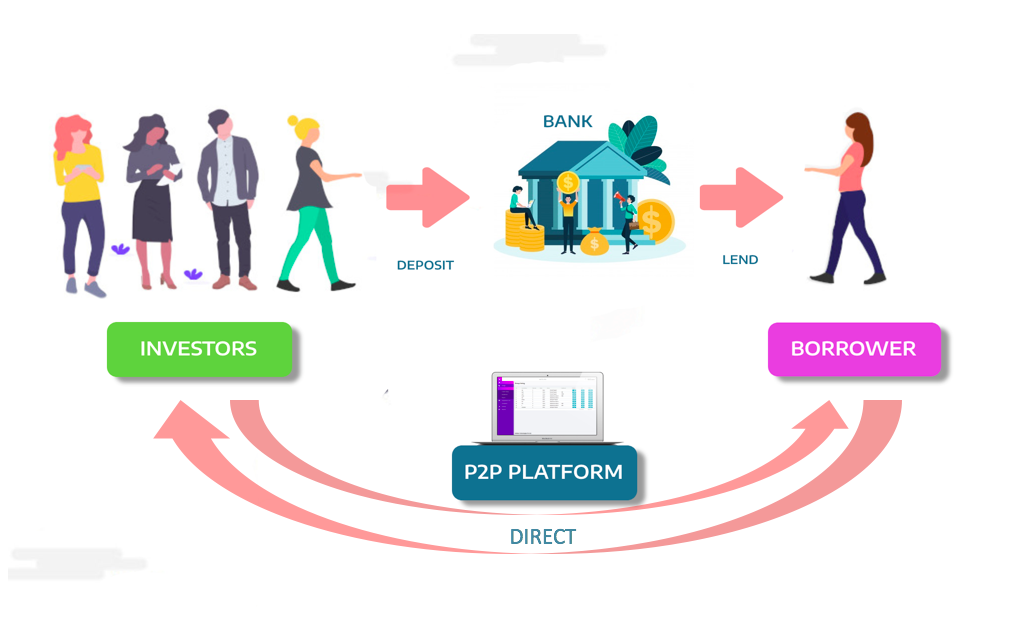

Peer-to-peer (P2P) lending platforms have revolutionized the way humans borrow and make investments money, providing a decentralized opportunity to standard banking institutions. in this weblog, we’re going to delve into the mechanics of peer-to-peer lending and provide a step-by means of-step manual on a way to use those structures successfully for borrowing or making an funding.

understanding Peer-to-Peer Lending

Peer-to-peer lending structures be a part of borrowers without delay with consumers, reducing out the intermediary normally associated to standard lending establishments. these structures facilitate lending transactions through on-line marketplaces, in which borrowers can request loans and buyers can fund them in change for returns.

The Borrowing system

Borrowing thru peer-to-peer lending structures entails numerous steps:

1. Registration: begin via developing an account on a good peer-to-peer lending platform. provide non-public and economic information as required for identification verification and chance assessment.

2. mortgage software program: submit a mortgage software program detailing =”hide”>the amount=”tipsBox”> you wish to borrow, the cause of the loan, and your selected reimbursement terms. Be prepared to provide extra documentation to help your software, which consist of proof of income and identification.

3. credit assessment: Peer-to-peer lending systems decide your creditworthiness based on elements which include credit score rating score, profits, employment facts, and debt-to-earnings ratio. This assessment enables determine the interest rate and loan phrases you qualify for.

4. mortgage listing: as soon as permitted, your loan request is listed at the peer-to-peer lending platform’s marketplace, in which buyers can assessment and fund individual mortgage listings based totally mostly on their investment standards and chance urge for meals.

5. investment and Disbursement: traders fund your mortgage via committing to invest part of the requested amount. as quickly as actually funded, the mortgage proceeds are dispensed to your financial institution account, typically within a few business organisation days.

using Peer-to-Peer Lending structures for Borrowing

right here are some tips for efficiently the use of peer-to-peer lending systems as a borrower:

1. evaluate gives: discover multiple peer-to-peer lending structures to examine mortgage gives, hobby prices, fees, and compensation phrases. select the platform that =”hide”>exceptional=”tipsBox”> meets your borrowing needs and offers competitive fees.

2. assessment Investor Profiles: buyers on peer-to-peer lending platforms have various hazard opportunities and funding techniques. assessment investor profiles and lending criteria to understand who is investment your mortgage and their funding music file.

3. maintain top verbal exchange: preserve investors informed approximately your mortgage development and any adjustments to your financial situation. easy communique builds do not forget and might enhance your chances of securing funding or renegotiating loan terms if needed.

using Peer-to-Peer Lending structures for investing

in case you’re thinking about making an investment through peer-to-peer lending structures, right here’s what you want to understand:

1. Diversify Your Investments: spread your investment throughout more than one loans to lessen risk and growth the hazard of incomes steady returns. Diversification permits offset capability losses from person mortgage defaults.

2. behavior Due Diligence: carry out thorough due diligence on borrower profiles, mortgage listings, and platform rules earlier than committing rate range. compare factors at the side of borrower creditworthiness, mortgage purpose, and historical platform usual performance.

three. monitor Your Investments: stay actively engaged together with your peer-to-peer lending portfolio through using tracking mortgage overall overall performance, monitoring payments, and assessing regular funding returns. modify your investment method as wanted primarily based mostly on market situations and platform inclinations.

quit

Peer-to-peer lending systems offer a convenient and on hand manner for people to borrow or make investments coins outside of traditional banking channels. via information the borrowing manner, challenge due diligence, and making use of 7339ff1fc90882f8f31ca1efdd2ac191 practices for borrowing or investing, you may make the most of these innovative financial structures and gain your monetary goals.

Questions and solutions

- How do peer-to-peer lending structures examine borrower creditworthiness?

- Peer-to-peer lending systems typically assess borrower creditworthiness based on elements which consist of credit score, earnings verification, employment facts, debt-to-income ratio, and mortgage motive. those systems use proprietary algorithms and hazard models to evaluate borrower profiles and assign appropriate interest fees and loan phrases.

- What are the capability =”hide”>dangers=”tipsBox”> of creating an investment in peer-to-peer lending systems?

- a few ability =”hide”>dangers=”tipsBox”> of investing in peer-to-peer lending systems embody borrower defaults, platform insolvency, lack of liquidity, regulatory modifications, and monetary downturns. customers should cautiously look at those =”hide”>risks=”tipsBox”> and diversify their investments to mitigate ability losses.

- Can debtors negotiate hobby expenses or mortgage terms on peer-to-peer lending systems?

- at the same time as debtors won’t have direct negotiation possibilities on peer-to-peer lending structures, they may be able to decorate their probabilities of securing favorable expenses and terms through manner of maintaining a sturdy credit profile, offering accurate information, and deciding on the maximum aggressive loan gives to be had on the platform.

- Are peer-to-peer lending structures regulated?

- Peer-to-peer lending platforms are issue to various stages of law relying on the jurisdiction and the specific sports they interact in. Regulatory oversight can also additionally embody licensing necessities, purchaser protection policies, and compliance with anti-cash laundering legal guidelines. investors and borrowers have to investigate the regulatory framework applicable to their chosen platform and recognize the related =”hide”>risks=”tipsBox”> and protections.